Financial stability and strength are the core of an association’s success. Our experienced accounting team is responsible for providing you with the financial reporting you need to ensure your community is financially sound. Allied Property Group prides itself in the highest security measures to guard against manipulation or fraud by separating accounting, collections, and accounts payable services.

As always, we have a checks and balances system in place. The payables are approved by the community manager, processed by our payables department, and reviewed by senior management.

Our accounting services include:

- Online payables processing

- Electronic signatures

- Accounts receivable collection process

- Effective internal controls

- Financial statement preparation

- Annual Budget preparation

- Lockbox services and remote deposit scanners

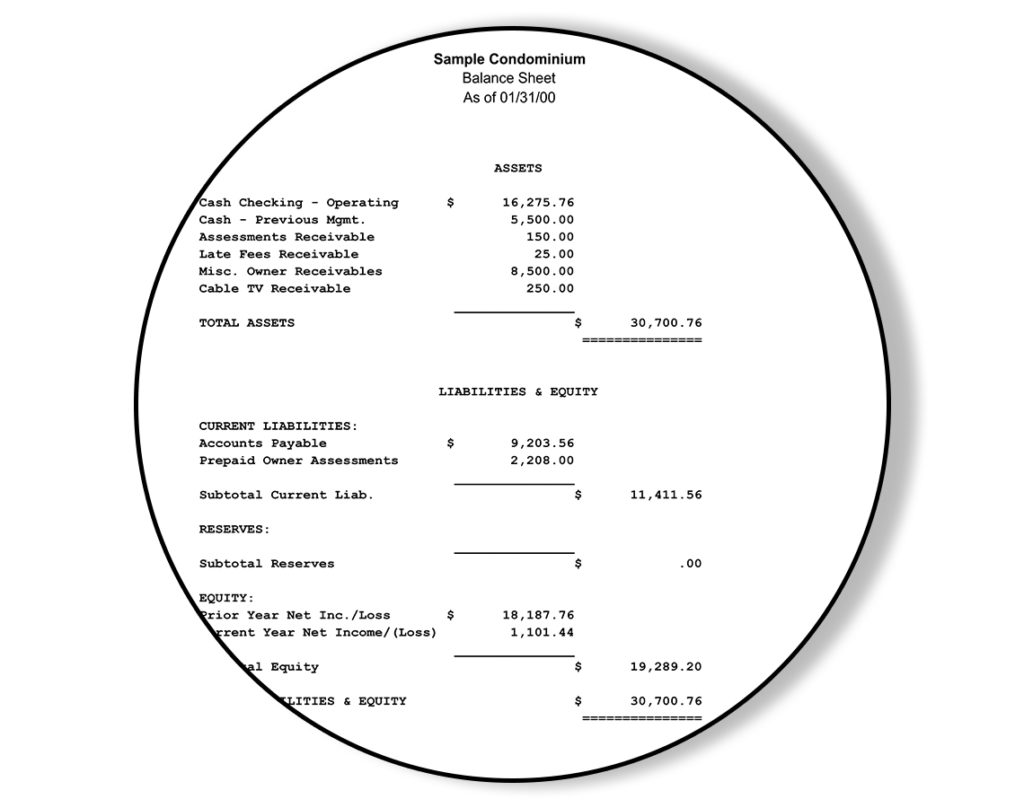

Balance Sheet

One of the reports included in the Financial Reports presented to the Board of Directors is the Balance Sheet. The Balance Sheet is a statement of the book value of all of the assets and liabilities (including equity) of the association. It provides a “snapshot” of the association’s financial standing as of the end of that particular month.

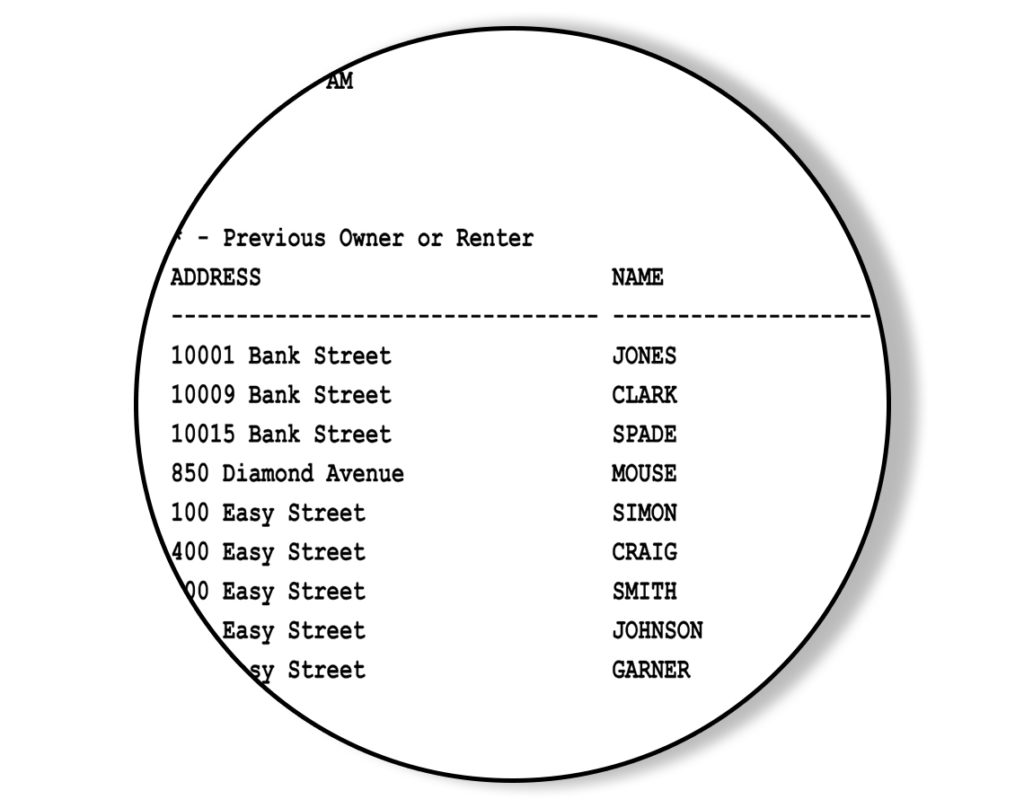

Collection Status Report

By far one of the most popular and most important reports is the aging report or the Collection Status Report. This report provides the Board with a listing of the owners that are past due. There are many variations of this report, however, the sample shown is the most concise. This report provides a glimpse of the names of those owners that are past due, the total amount past due, and at what stage in the collection process the account is in.

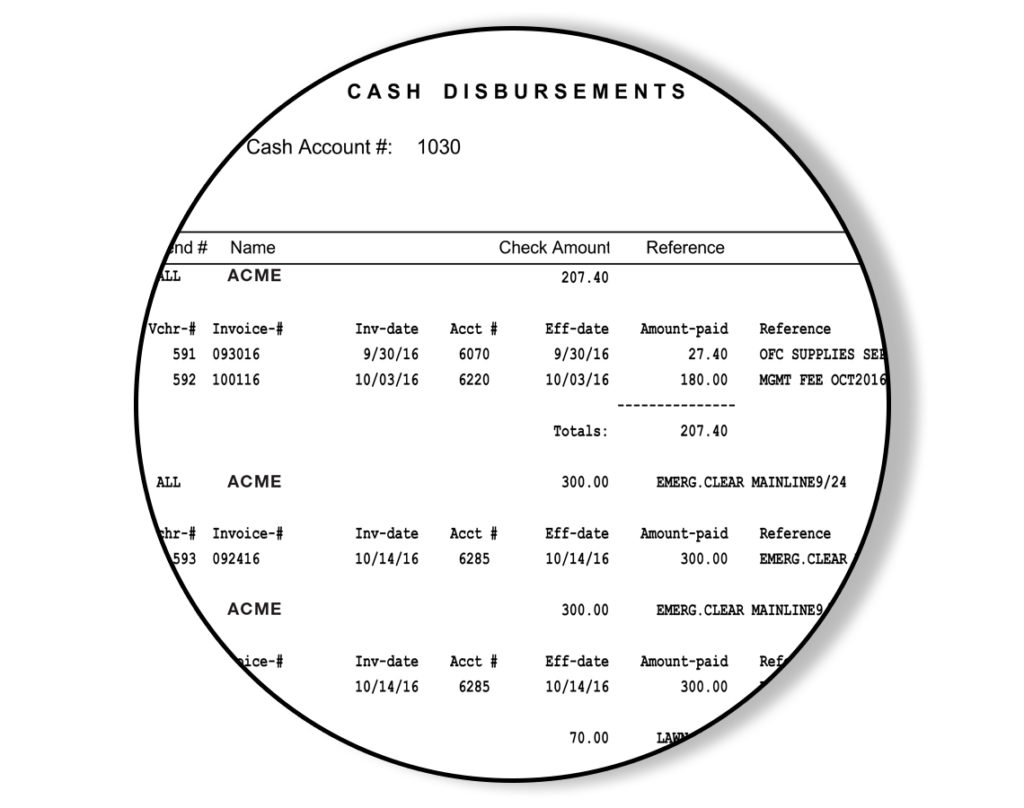

Check Register

Allied Property Group, Inc. also includes a Check Register in its monthly report. This report is a list of all of the checks written by the association during a given period, typically each month. Among other information, it lists, the check number, the vendor’s name, the invoice number, brief description of the payment, and the check mount.

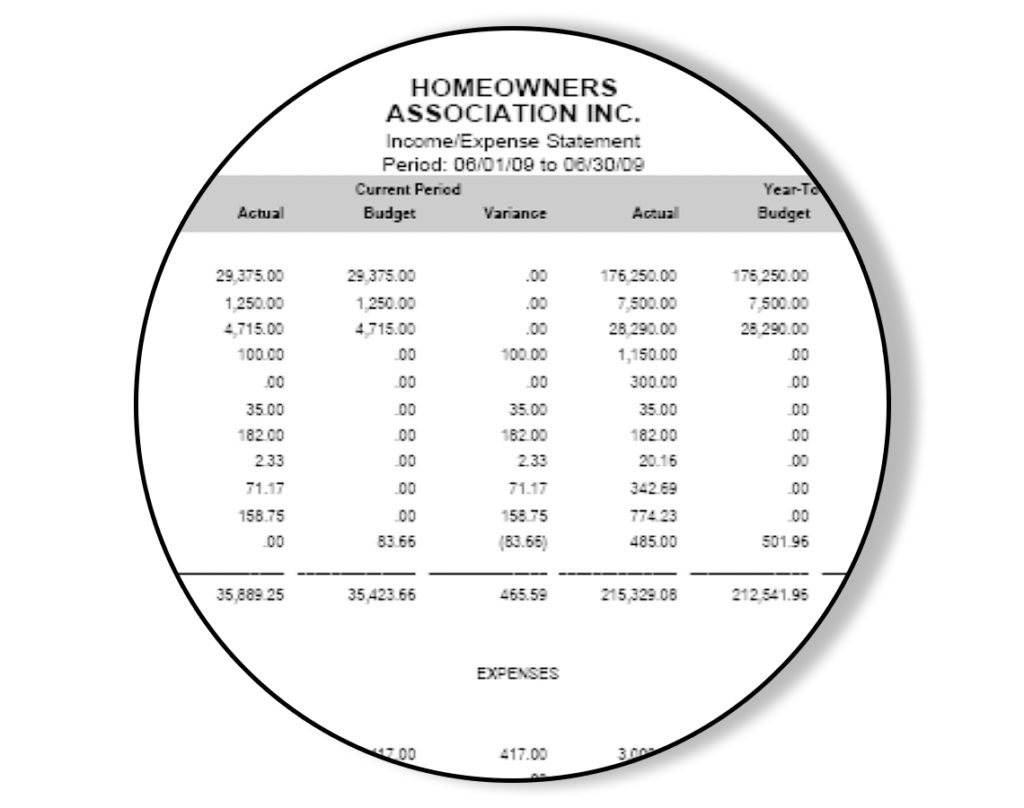

Profit & Loss Report

The second page of the Financial Report summarizes the revenues, costs and expenses incurred during a specific period of time. The Income and Expense Report follows a general format that begins with an entry for Income and subtracts from Income the costs of running the business, including operating expenses, insurance, contracted vendors, and repairs. The bottom line, literally and figuratively, is net income or loss.

Because we know Associations depend on their budget, our P&L reflects the Actual Expenses vs. the Budget Amount. This comparison is done for the current month as well as year-to-date. You are also provided with the variance (if any) between the actual expense and the budgeted amount.

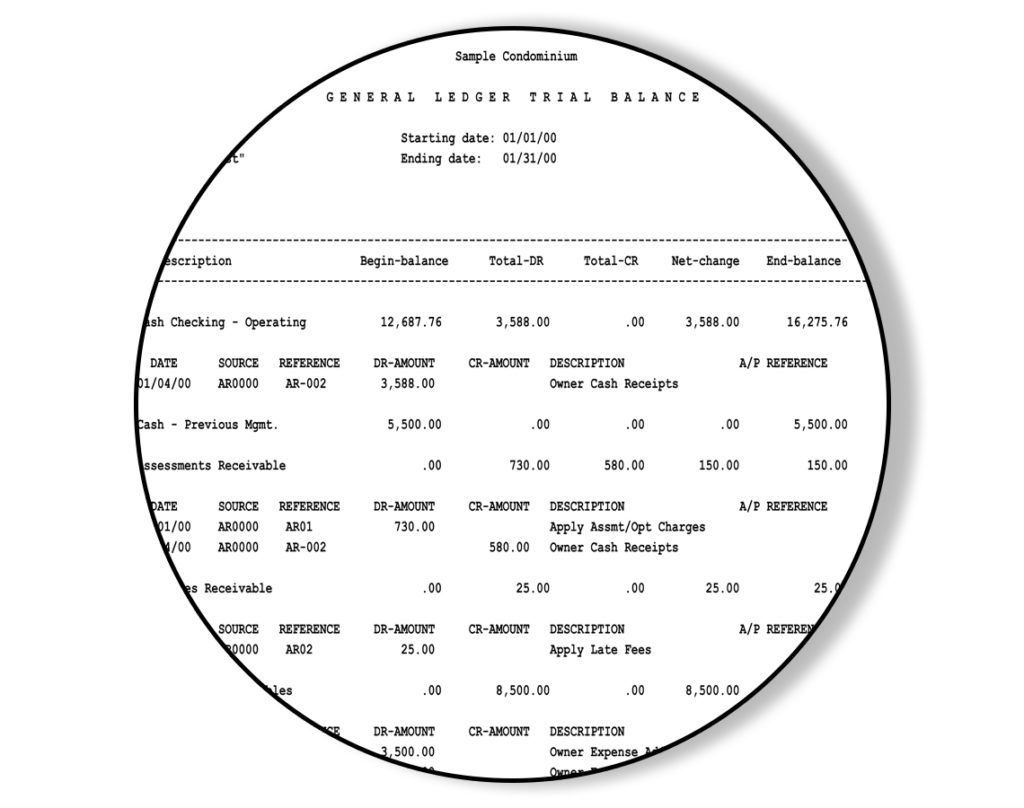

Monthly Ledger

The Monthly General Ledger is the main accounting record of a business which uses double-entry bookkeeping and is a summary of all of the transactions that occur in the company. It is built up by posting transactions recorded in the general journal. The Balance Sheet and the Income and Expense Report are both derived from the general ledger. The general ledger is where posting to the accounts occurs. Posting is the process of recording amounts as credits and debits in the pages of the general ledger. Because each bookkeeping entry debits one account and credits another account in an equal amount, the double-entry bookkeeping system will ensure that the general ledger will always be in balance.

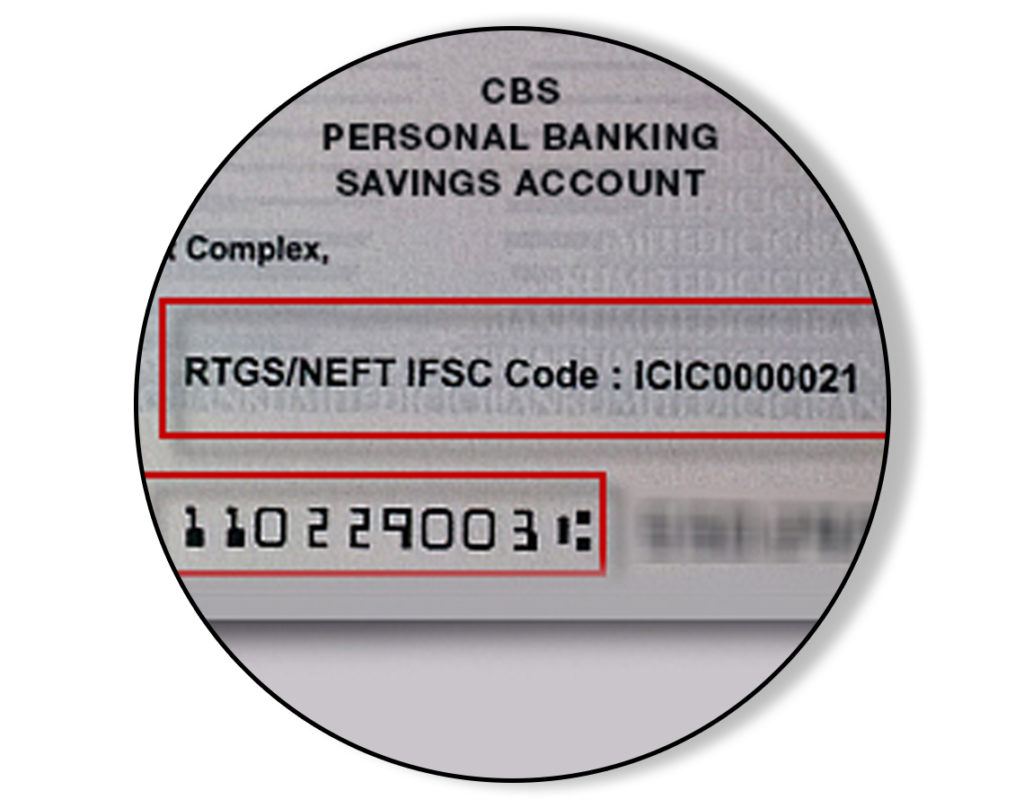

MICR Check Scanning (AR)

This scanner will allow Allied Property Group, Inc. to scan owner payments directly into its software using a MICR check scanner. This will allow Allied Property Group, Inc. to process checks faster and eliminate errors. The MICR Check Scanner reads the magnetic codes from the bottom of an owner’s check. A database is automatically created that stores the owner’s bank information. After the check has been scanned once, the software knows what home the check should be applied against. The next time it reads the owner’s check, it automatically selects the home. All we will have to do is enter the check amount and we’re done!